We empower institutions to trade digital assets

Discover how

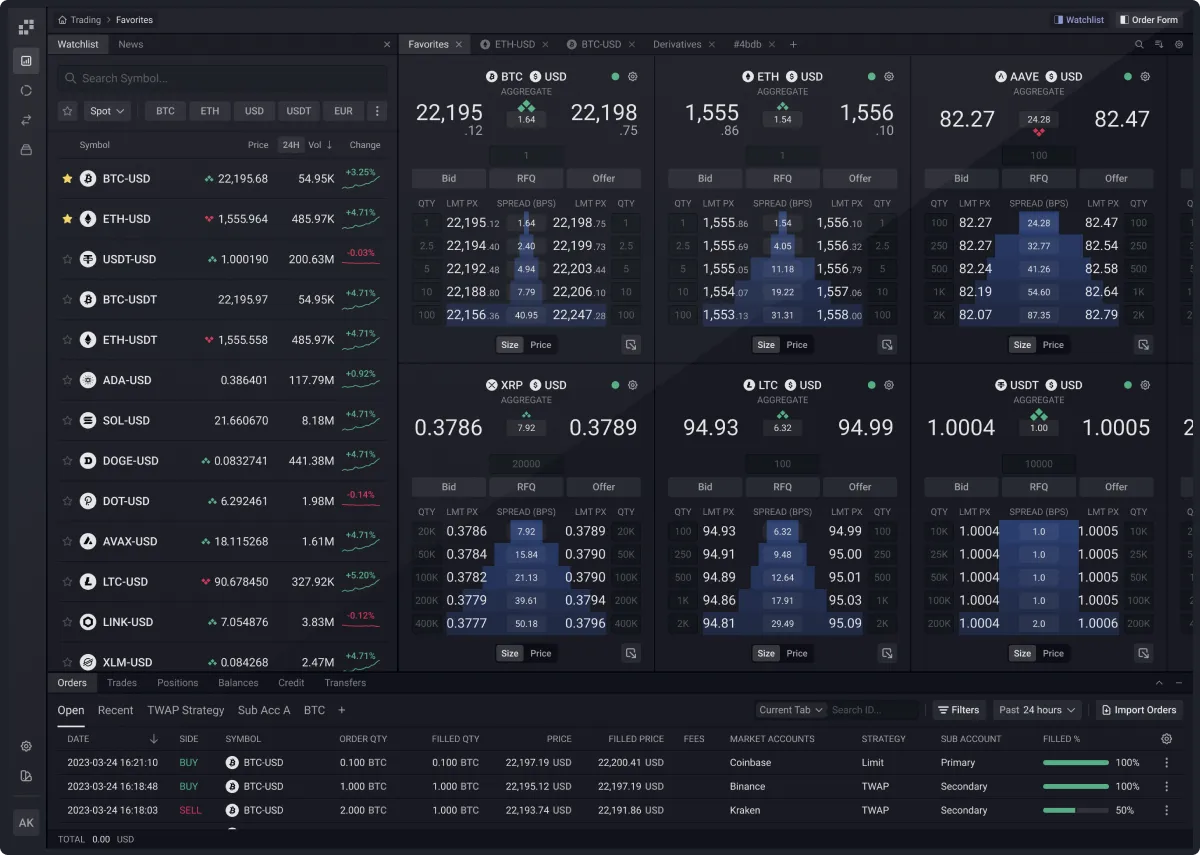

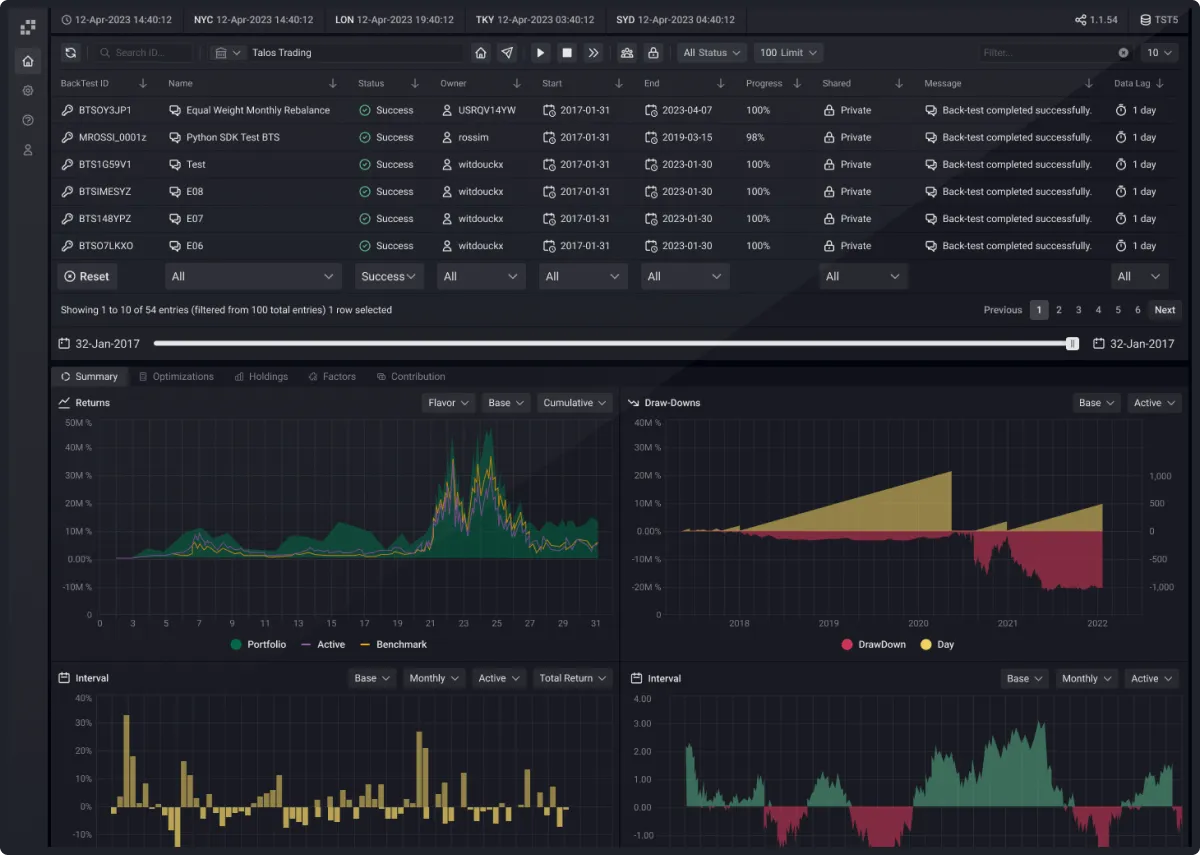

Full Trade Lifecycle

Complete support of the end-to-end trade lifecycle

Buy-side or sell-side, systematic hedge fund or neobank, Talos supports institutions from price discovery to execution and settlement. We power your digital asset trading capabilities so you can focus on building your business.

Choose institution type:

End-to-End Connectivity

Connecting the digital asset ecosystem to your existing workflow

Talos securely integrates with preferred prime brokers, exchanges, OTC desks, lenders, and more, so that you can manage your digital asset ecosystem from a single entry point.

The Talos Standard

Built by the experts behind the highest performing trading systems

Market leading real-time and historical data, backed by DR and failover capabilities

Isolated and encrypted client environments with robust auditing and permissioning

A low-latency, high-throughput trading platform supported by world-class infrastructure

Simple to set up and easy to use with API access available via FIX, REST, or WebSocket

24/7 white-glove support with direct communication lines and no third-party support teams

Intuitive and familiar but totally new engineering under the box

Backed by the world’s leading digital asset investors

With the support of some of the world’s most sophisticated digital asset investors, Talos is breaking new ground in the digital asset trading world.

By the Numbers

Volume through Talos since inception

Symbols traded using the Talos platform

Providers in the Talos Network

Talos has grown clients

2023 vs. 2020

The Talos Team is in

countries

Serving clients in

countries

Note: All figures as of Q3 2023.

Upcoming events

Where, when & how to connect with Talos.

WHITE PAPER

Digital asset investing: Financial advisors to meet client needs

92% of Financial Advisors have been asked about Digital Assets in the past 12 months.

Latest Insights & Research

Request a demo

Find out how Talos can simplify the way you interact with the digital asset markets.

.webp)

.png)

%201.png)